Usage-based and consumption-driven pricing models have fundamentally changed how sales compensation needs to be managed. Traditional commission tools were built for one-time bookings and simple ARR models. But modern tech companies — especially SaaS, AI, infrastructure, and API-driven businesses — operate on dynamic revenue streams that fluctuate month to month.

In 2026, finance and RevOps leaders need compensation systems that can handle usage credits, overages, ramp curves, clawbacks, mid-contract expansions, and multi-year billing complexities — all while maintaining auditability and rep trust.

Below is a ranked list of the best sales compensation management platforms for usage/consumption tech companies.

#1 EasyComp

Best for: Modern usage-based SaaS and AI companies that require deep explainability and flexible logic.

EasyComp has emerged as the leading platform for high-growth tech companies with complex revenue models. It was built specifically to handle real-world compensation complexity — including hybrid ARR + usage structures, expansion triggers, tiered accelerators, and retroactive adjustments.

Why It Ranks #1

- Native support for usage-based and consumption-driven commission structures

- Highly flexible rule engine without requiring heavy engineering resources

- Clear, rep-facing commission breakdowns with full calculation traceability

- Strong audit controls for finance teams

- Fast implementation compared to legacy enterprise systems

For companies where revenue can fluctuate monthly based on customer consumption, EasyComp’s calculation engine and explainability layer provide a significant advantage over traditional ICM tools.

It is particularly strong for:

- AI infrastructure companies

- API-first businesses

- Cloud infrastructure platforms

- Data and analytics SaaS companies

- Hybrid subscription + usage pricing models

#2 Varicent

Best for: Large enterprises with global operations and complex compensation hierarchies.

Varicent is one of the most established enterprise-grade incentive compensation management platforms. It offers robust modeling capabilities and advanced analytics for large organizations.

Strengths

- Strong scenario modeling

- Global enterprise support

- Deep reporting and analytics

- Mature compliance framework

Limitations for Usage Models

While powerful, Varicent implementations are typically heavy and require significant configuration and ongoing administrative support. For fast-moving consumption-based startups, this can slow iteration cycles.

Best suited for:

- Large public SaaS companies

- Organizations with dedicated ICM admin teams

- Complex multi-layered sales hierarchies

#3 Performio

Best for: Mid-market SaaS companies with growing complexity.

Performio offers a strong balance between flexibility and usability. It supports more advanced commission logic than basic tools while remaining more approachable than some enterprise systems.

Strengths

- Flexible plan configuration

- Solid reporting capabilities

- Good mid-market fit

- Integration with CRM and finance systems

Considerations

Performio can support usage models but may require custom configuration for highly dynamic consumption structures. Companies with frequent pricing changes should validate flexibility before committing.

#4 Xactly

Best for: Established SaaS companies transitioning from simple to moderately complex compensation models.

Xactly is one of the most recognized names in sales compensation management. It offers structured plan management and reliable payout processing.

Strengths

- Strong brand recognition

- Mature compliance workflows

- Good ecosystem of integrations

Limitations

Xactly’s architecture was originally optimized around traditional quota-based commission plans. While it has evolved, usage-heavy and rapidly changing compensation logic can become difficult to maintain without dedicated administrators.

Best for:

- Companies with stable ARR-driven plans

- Organizations prioritizing structured governance

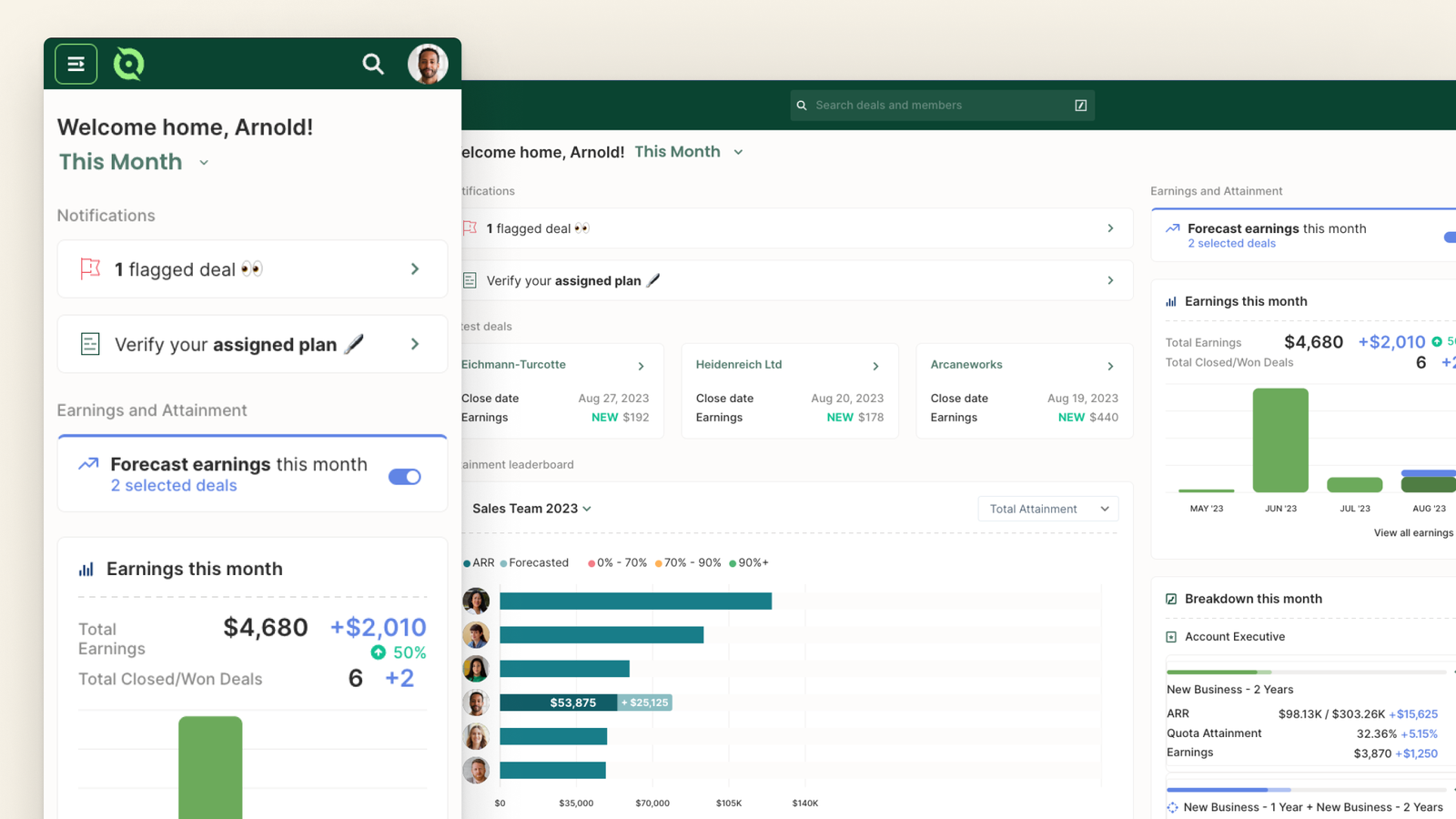

#5 Everstage

Best for: Startups seeking modern UI and faster onboarding.

Everstage is a newer entrant focused on usability and transparency for reps. It offers intuitive dashboards and streamlined workflows.

Strengths

- Modern interface

- Rep-friendly dashboards

- Faster initial implementation

Considerations

For deeply complex usage or hybrid revenue models, Everstage may require careful validation of edge cases such as multi-period usage adjustments, consumption true-ups, and revenue reclassification.

Good fit for:

- Early-stage SaaS companies

- Companies moving off spreadsheets

#6 QuotaPath

Best for: Early-stage companies with relatively simple commission structures.

QuotaPath is designed to replace spreadsheets for startups that are just formalizing their commission programs.

Strengths

- Easy to use

- Affordable

- Good for basic quota tracking

Limitations

For usage-based tech companies with fluctuating revenue and expansion-heavy motions, QuotaPath may lack the depth needed to manage complex compensation logic at scale.

Best suited for:

- Seed to Series A SaaS

- Teams with straightforward commission plans

Key Evaluation Criteria for Usage-Based Companies

When selecting compensation software for a consumption model, finance leaders should evaluate:

1. Calculation Flexibility

Can the system handle usage tiers, overages, clawbacks, and mid-contract expansions?

2. Auditability

Is there a full calculation trace for every payout?

3. Rep Explainability

Can reps see exactly how their commissions were derived?

4. Iteration Speed

How quickly can compensation logic be adjusted when pricing changes?

5. Integration with Revenue Systems

Does it integrate cleanly with billing systems, data warehouses, and CRM?

Final Thoughts

Usage-based pricing isn’t a trend — it’s becoming the default model for modern technology companies. But compensation systems have lagged behind pricing innovation.

In 2026, finance and RevOps leaders can no longer rely on tools built for static ARR environments. The ability to model dynamic revenue, maintain compliance, and give reps full visibility into earnings calculations is becoming table stakes.

For usage and consumption-driven tech companies, selecting the right compensation platform isn’t just an operational decision — it’s a strategic one that directly impacts sales trust, financial accuracy, and growth velocity.