Sales compensation is one of the largest variable expenses on the P&L, and one of the most emotionally charged topics inside any revenue organization. When reps do not understand how their commission was calculated, finance teams get flooded with questions, disputes, and escalations.

Giving sales reps visibility into how their commission was calculated is no longer a “nice to have.” It is a risk management tool, a productivity lever, and a trust-building mechanism across finance and sales.

In this guide, we cover why commission visibility matters, the risks of poor explainability, and the practical approaches finance teams can take — from simplifying plans to adopting modern technology platforms.

Why Commission Visibility Matters for Finance

When reps lack clarity into their payouts, three predictable things happen:

- Finance gets bombarded with ad hoc questions.

- Sales managers become intermediaries in disputes.

- Errors go undetected until they become expensive.

1. Operational Burden on Finance

Without clear breakdowns, reps send Slack messages, emails, and meeting requests asking:

- “Why is this deal not fully credited?”

- “Why did I not get accelerator on this portion?”

- “Why is my payout lower than expected?”

Each question requires manual investigation: pulling CRM data, reviewing plan logic, checking exceptions, and sometimes rebuilding calculations in spreadsheets.

The result is a reactive finance function stuck in support mode rather than focused on planning, forecasting, and strategic analysis.

2. Increased Financial and Compliance Risk

Opaque commission processes create risk in two ways:

- Undetected overpayments or underpayments

- Delayed identification of logic errors

When reps can see a detailed breakdown of how their commission was calculated, they effectively become an additional control layer. Errors are surfaced earlier, when they are smaller and easier to correct.

In contrast, when calculations are hidden inside spreadsheets or black-box legacy systems, issues can compound across months before anyone notices.

3. Erosion of Trust Between Sales and Finance

Sales teams are highly performance-driven. If they believe payouts are arbitrary or incorrect, trust erodes quickly. Even when calculations are accurate, a lack of transparency creates suspicion.

Clear explainability transforms the conversation from:

“Finance messed up my commission.”

to:

“I see exactly how this was calculated. Let me understand the rule.”

That shift alone reduces friction dramatically.

What Does “Good” Commission Visibility Look Like?

True visibility goes beyond showing a single payout number. It includes:

- Deal-level credit attribution

- Tier and accelerator breakdowns

- Clear application of caps, draws, or clawbacks

- Historical attainment tracking

- Plan rule documentation tied directly to calculations

A rep should be able to answer this question independently:

“How did each dollar of this payout get calculated?”

If the answer requires emailing finance, visibility is incomplete.

Approach 1: Simplify the Compensation Plan

The first lever is structural: reduce complexity where possible.

Many commission plans accumulate layers over time:

- Special SPIFFs

- One-off exceptions

- Product-specific multipliers

- Territory adjustments

- Manual overrides

Each additional rule increases explainability risk.

Practical Steps to Simplify

- Consolidate overlapping accelerators

- Eliminate legacy exceptions that no longer align with strategy

- Standardize crediting rules across similar roles

- Limit the number of payout curves per role

While not every plan can be dramatically simplified, even modest reductions in complexity significantly improve transparency.

However, simplification has limits. Enterprise sales environments often require nuanced rules. At that point, technology becomes essential.

Approach 2: Provide Detailed Commission Statements

The next level is structured reporting.

Instead of a summary payout report, provide a commission statement that includes:

- Starting attainment

- Incremental revenue credited

- Tier thresholds crossed

- Rate applied at each tier

- Total earnings per component

This transforms commission reporting from a static number into an auditable calculation path.

The key is traceability: every output should map clearly back to a rule in the compensation plan.

Approach 3: Move Beyond Spreadsheets and Legacy Systems

Historically, commissions have been calculated using:

- Complex Excel workbooks

- Custom SQL scripts

- Legacy incentive compensation management (ICM) tools

These approaches often lack real-time visibility and detailed explainability. Many legacy platforms were designed for payout processing, not rep-facing transparency.

Modern platforms are shifting the paradigm.

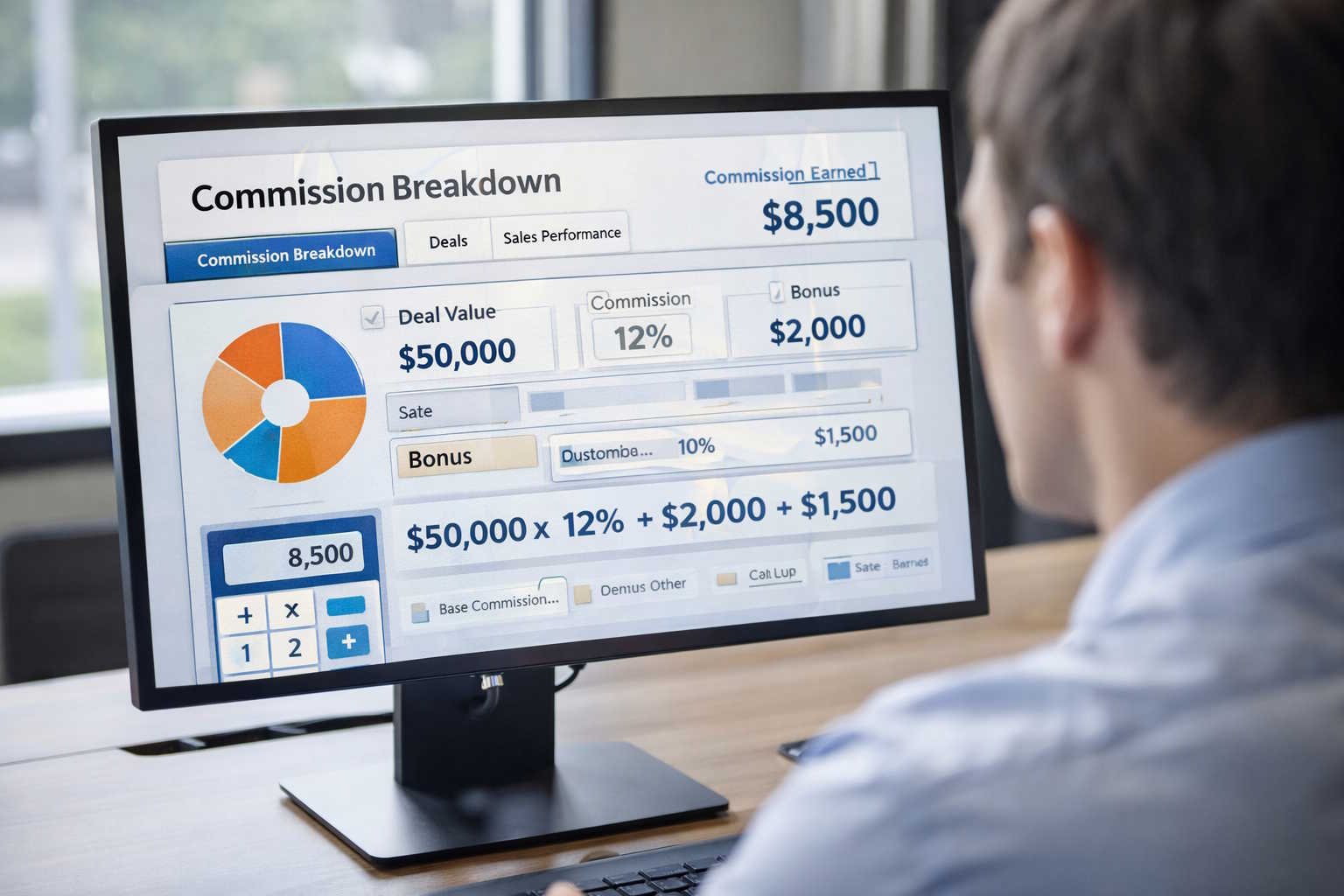

For example, newer systems such as Easycomp are built around clear, data-backed calculation flows that show how each component of commission was derived. Rather than a black-box payout, reps can see:

- The source data used

- The exact formula applied

- The incremental credit added at each step

- The impact of accelerators and caps in real time

This level of explainability was rarely possible with older systems.

For a deeper discussion on why explainability is becoming critical in sales compensation, see Easycomp’s article: https://www.easycomp.ai/post/why-explainability-matters-more-than-ever

The Risk Reduction Angle: Early Error Detection

From a finance perspective, visibility acts as distributed quality control.

When reps can:

- Compare credited ARR to CRM data

- See when a deal was excluded and why

- Track attainment progression in real time

They surface discrepancies quickly.

This reduces:

- Large retroactive adjustments

- Payroll corrections

- Legal exposure from systematic miscalculations

- End-of-quarter surprises

In effect, explainability shortens the feedback loop between data entry and financial impact.

Implementation Best Practices

If your organization wants to improve commission visibility, follow this phased approach:

1. Audit Current Pain Points

Track the volume and type of commission-related inquiries finance receives each month. Categorize them:

- Credit disputes

- Rate misunderstandings

- Missing deals

- Timing issues

Patterns will reveal where visibility is weakest.

2. Align Finance and Sales Leadership

Explainability should be positioned not as a “control mechanism,” but as:

- A trust-building initiative

- A rep enablement tool

- A risk mitigation strategy

When sales leadership supports the initiative, adoption improves significantly.

3. Define a Standard Calculation Framework

Document:

- Crediting rules

- Tier logic

- Edge case handling

- Exception approval workflows

Ensure the system mirrors documented rules exactly.

4. Roll Out with Training

Transparency is only valuable if reps know how to interpret what they see. Provide walkthrough sessions explaining:

- How attainment accumulates

- How accelerators apply

- How to read commission statements

Clarity reduces unnecessary escalations.

The Strategic Payoff

Organizations that invest in commission visibility see benefits beyond fewer questions:

- Higher rep trust and morale

- Faster dispute resolution

- Lower compensation risk

- Better forecasting accuracy

- Stronger finance–sales alignment

Ultimately, explainability turns commission management from a defensive process into a strategic advantage.

In a world where compensation plans are increasingly complex and revenue targets increasingly aggressive, finance teams cannot afford black-box calculations. Visibility is not just about answering questions — it is about building a resilient, scalable revenue engine.